Automated Invoice Data Entry

and Verification

Our AI-driven solution reads invoice details and accelerates data entry. Additionally, it enhances efficiency by automatically inferring account codes for journal entries, ensuring compliance with various legal and regulatory requirements, and integrating seamlessly with ERP and workflow systems via API connectivity.

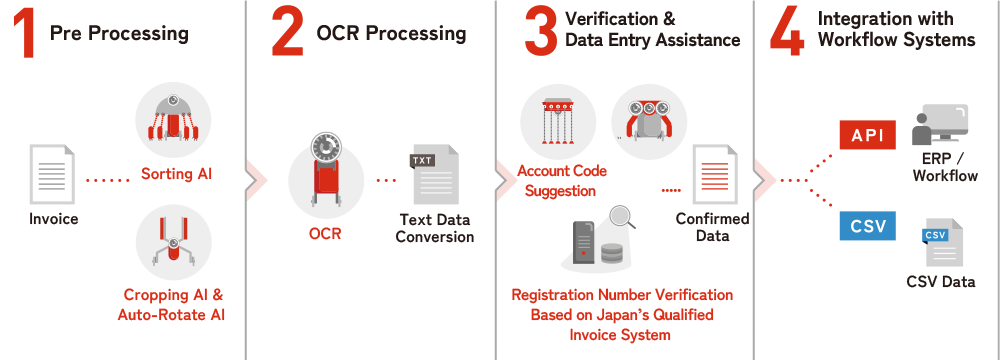

AI Powered Accounting Workflow

-

Pre Processing

Before OCR processing, our AI isolates only the necessary documents and performs corrections. For multi-page PDF files scanned using multifunction devices, the system automatically separates invoices, detects attached invoices on application forms used by each company, and performs auto-rotation to ensure proper orientation.

-

OCR Processing

The AI reads information listed on the invoice and converts it into text data. There's no need to pre-define templates for individual invoices; the AI recognizes and reads the content automatically. (Some invoices and details may require learning.)

-

Verification & Data Entry Assistance

Our AI verifies the extracted data against master data to confirm invoice information. It also assists in data entry by suggesting account codes based on information such as amounts, dates, and payees.

-

Integration with Workflow Systems

The extracted data can be integrated with ERP and workflow systems via API, eliminating the need for manual data entry and streamlining operations. Integration via CSV files is also possible.

Tips & Insight: Preparing for Japan’s Invoice System

In Japan, the Qualified Invoice System was introduced in October 2023. Under this system, qualified invoices must include six mandatory items, and recipients are required to verify that all necessary details are correctly stated. One of the most time-consuming tasks is verifying the registration number of the issuing business.

At Fast Accounting, we are implementing an AI-powered solution that reads the registration number from qualified invoices and checks its validity. Additionally, if an invoice is missing a registration number, our system will determine whether it is due to an omission or if the issuer is not a registered business.

Furthermore, our solution includes a calculation verification feature that checks whether the total amount and consumption tax for each tax rate are correctly calculated. By automating these processes, we aim to significantly improve operational efficiency and reduce manual workload.

Customer Stories

-

Asahi Kasei Corporation

- Key Benefits

-

• Significant cost reduction

Reduced workload and prevention of human errors

• Quick and accurate compliance with Japan’s Invoice System and Electronic Accounting Record Keeping Law

• Continuous accuracy improvement with AI-OCR learning from scanned data

• Achieved workstyle reforms

[Remota] [Robota]

-

Omron Expert Link Co., Ltd.

- Key Benefits

-

• Automated checks and approvals for approx. 50% of payment vouchers

• Significantly reduced workload

• Eliminated the need for manual checks, reducing pressure on employees

• Ensured compliance with Japan’s Invoice System

• Time savings, cost reduction, and error minimization

[Robota]

Services

-

Digital Invoice